VIVA – Managing personal finances on a minimum wage can seem difficult in the current economic crisis. Rising commodity prices, constant inflation and pressure on the cost of living make it difficult for many workers to save or invest.

Read also:

Integration of Jurnal Mekari accounting system with artificial intelligence technology for business efficiency

With the right strategy, we can effectively manage our UMR salary and still build a solid financial foundation. Below is a summary of the strategy implementation. financial impact I like it I like it Felicia Putri Tjiasaka and David Vijaya. This article will help us develop practical steps to achieve financial stability, even with a UMR salary.

A combination of sources of influential Felicia, who highlights the importance of emergency funds, extra income and investments, as well as David Vijaya’s material on the purchasing hierarchy and the use of free financial programs, good guide.

Read also:

Spending Gen Z is trapped! See how financial experts manage money for a better future

-

Monthly Financial Budget: A useful free app

The first step to managing personal finances is to create a financial budget. Free app for financial management. from the instagram page David Vijaya x Michelle Purma.

Read also:

Tips for keeping the middle class prosperous

-

Prioritize emergency funds

according Felicia Putri Tjiasakaa person financial influencerThe first step in managing your UMR payroll is to have emergency funds ready. ““Prepare for the worst” or emergency funds are the top priority of financial management.

According to Felicia Putri, the emergency fund model

- youtube.com/Felicia Putri Tjiasaka

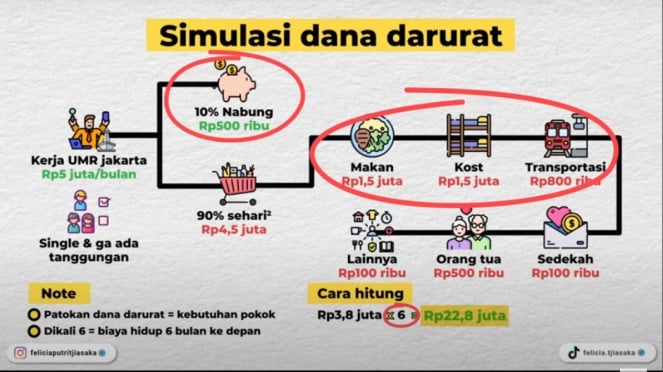

Felicia Putri Tjiasaka recommends saving at least 10% of monthly income for an emergency fund. This emergency fund should cover our basic needs for six months.

According to Felicia Putri, the process of simulating the emergency fund

- youtube.com/Felicia Putri Tjiasaka

To calculate it follow these steps:

- Add up your monthly basic needs: Calculate all the costs of your basic needs such as food, accommodation and transportation.

- multiply by 6: Multiply your total monthly expenses for basic needs by 6. This is the perfect amount to save for an emergency fund.

By having enough emergency funds, we will be better prepared to face unexpected situations such as layoffs or emergency needs, and we will be able to survive for six months while we look for a new job or find additional sources of income.

-

Saving money is not a long-term solution

Felicia also emphasized that saving is not a long-term solution once you’ve gathered all your emergency funds. “Saver There is no solution». If there is nothing else that can be reduced» Revenue growth is the only way“ explained. Looking for extra income or second job The solution is to increase income and expand our financial opportunities.

-

Investment for the future

Felicia emphasized the importance of investing as part of personal financial management. “Make money work for you” investing using the 10% deposit fee previously.

Allocate 10% of your monthly income to investing in instruments that fit your risk profile, such as mutual funds, savings, stocks, or buying and selling gold, both physical and digital.

-

Control your lifestyle and your expenses

The key to success in managing personal finances is discipline in controlling your lifestyle. Avoid impulse purchases and evaluate each purchase. When shopping, it is important to follow a purchasing hierarchy or order of preference. This concept helps us to increase our budget intelligently. The order of purchasing preferences that we can apply are: according David Wijaya, Michel Purnama and Youthranger.id:

- Existing use: Prioritize the use of assets or resources that we have first. This helps to avoid unnecessary expenses.

- Rent or loan: If you don’t have the items you need, rent or borrow them. It’s an economical solution and reduces the cost burden.

- Exchange items: If renting or borrowing is not an option, consider bartering with other people. This can help us get the things we need without spending a lot of money.

- Purchase of used goods: If the above options are not possible, buying used items can be a good alternative. Usually, used products are cheaper and can meet your needs.

- Make your own: If buying a used item is not an option either, try making it yourself. This can be a creative and cost-effective way.

- Buy new: Finally, if all the options mentioned above have been considered and there is no other solution, we consider purchasing a new item.

-

Saving mode

Besides investing, regular saving is also very important. Set aside at least 10% of your income each month. Saving helps us achieve long-term financial goals like buying a house, a car, or preparing funds for education. Also, make sure to keep your savings in a safe place and separate it from your daily account so that it is not easy to use.

-

Avoid unnecessary debts

Avoid taking out unnecessary loans, especially those with high interest rates. If you have debt, make a plan to pay it off on time and prioritize paying off the debt with the highest interest rate first. This way, you can avoid financial problems in the future.

How to manage personal finances It requires careful planning and discipline. The point is, don’t use your UMR salary as an excuse not to save and invest. »Let’s start with what we can.“said Felicia Putri Tjiasaka. Small steps in personal financial management will have a big impact in the long run.

5 functions of financial management and its purposes that you should know

How can financial management have a huge impact on businesses? Learn the 5 important functions of financial management and its purpose!

VIVA.co.id

September 20, 2024