United States, VIVA – This week’s meeting of the Federal Open Market Committee (FOMC) featured an unusual atmosphere of secrecy. Economists expect the Fed to split into two camps and the meetings to be characterized by battles of opinion among its members.

Read also:

BI predicts the Fed will cut interest rates three times this year

Markets have collectively decided that the US Federal Reserve (FED) will cut interest rates in September. However, there is intense debate about how far Jerome Powell will go.

Whether a traditional rate cut of a quarter percentage point or 25 basis points can be applied, or will the Fed take an aggressive first step with a 50 basis point cut for the first time?

Read also:

Five reasons why BI will cut interest rates before the Fed

Late last week, market participants were closing in on the possibility that the Federal Reserve would cut interest rates by 25 basis points. Then, on Friday, sentiment suddenly changed with half a point on the line.

Read also:

The impact of the Fed’s interest rate cut on the global economy

Recently, most futures fund traders predicted a higher probability of a 63 percent drop. This indicates that confidence levels are higher than at the previous Fed meeting.

Former Dallas Federal Reserve President Robert Kaplan predicts that the debate in the FOMC meeting room should be interesting. When members are meant to be divided, they will typically vote with one voice.

“I think they are divided,” he said.

Kaplan said there will be some people at the negotiating table who will want to come back and not spend the fall chasing the economy. Meanwhile, other groups, looking at it from a risk management perspective, think they want to be more cautious.

“For the Fed, this is a risky decision. If you cut by 50 basis points, you could reintroduce inflationary pressure, while if you cut by 25 basis points, there is the possibility of a recession,” explained Seema Shah, global head of fixed asset management. CNBC Wednesday, September 18, 2024.

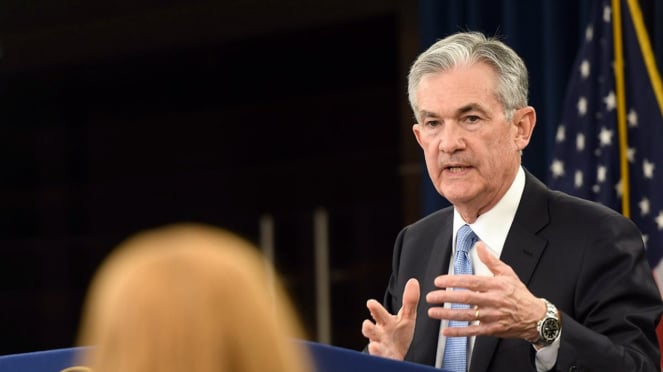

Federal Reserve Governor Jerome Powell

- Twitter.com/@reservafederal

Shah added that the Fed would be more cautious about reactivity than the risk of recession. This came after Jerome Powell was criticised for his slow response to the US inflation crisis.

In addition, US economist Tom Simons said the Federal Reserve must act quickly if it does not want to take on worse risks. However, Simons warned that policymakers should be confident or not rush to cut interest rates.

“The intensification experiment, while apparently successful, did not go as well as they thought, so relief should be viewed with the same uncertainty,” Simons said.

Moody’s Analytics chief economist Mark Zandi thinks the Fed will cut interest rates by 25 basis points. Still, he expects Powell to cut by 50 basis points.

“My expectation is 50 because I think interest rates are too high. The Fed has fulfilled its mandate to get employment back to full and inflation back to target,” Zandi said.

Zandi also said that the fund’s current interest rate target of around five and a half percent is no longer appropriate. This is why Zandi is quickly stabilising interest rates to leave plenty of room for economic growth.

Next page

“I think they are divided,” he said.